Settlement circumstances in Southeast Asia explored by Omise Intern Vol.1 Thailand

Hi I’m Keigo, an intern at Omise Japan Co. Ltd.. Three months have passed since I started my internship in this company. Omise is a company based in Thailand that is developing online payment services in several countries including Japan and Singapore. To the best of my knowledge, settlement which is Omise’s business domain, deepens through daily work. I came to wonder how the settlement circumstances differ between Japan and Southeast Asian countries. Therefore I decided to compile it into a blog this.

Fast growing Southeast Asia

Southeast Asia has achieved rapid economic growth against the background of population growth and infrastructure development. However, according to the World Bank, there are still more than 200 million people in Southeast Asia that do not possess financial institution accounts. Omise has chosen “Online Payment for Everyone” as a corporate vision and is trying to deliver payment services to people who have not use such financial services.

Even though we group many countries in Southeast Asia together, the economic levels vary from country to country. In fact, comparing per capita GDP in 2016, Singapore is over 40 times richer than Cambodia (* 1). Due to the diversity in Southeast Asia, I decided to look into Thailand’s settlement circumstances with Omise’s head office.

Thailand’s financial infrastructure

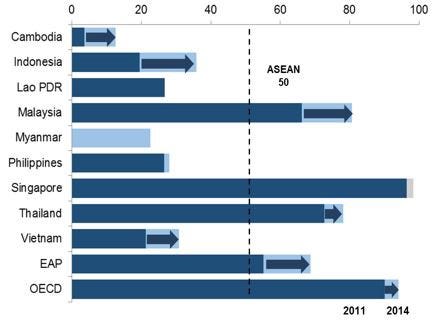

Thailand with a population of about 65 million people has achieved relatively good economic growth in Southeast Asia with GDP per capita of about 6,000 dollars (about 39,000 dollars in Japan) (* 1). In Thailand, 70% of the adult population holds bank accounts. It is higher than the average 50% in other Southeast Asian countries. The debit card holding rate also exceeds 50%. Its settlement infrastructure is growing (* 2).

The currency used in Thailand is the Baht. Foreign exchange is about 1 baht = 3.4 yen (November 1, 2017). There are five types of banknotes and coins, and the maximum amount is 1,000 baht bills. Pictured on all banknotes is King Bhumibol Adulyadej who past away last year. It can be seen that he was widely loved among the people.

Interview with Thai office members

In order to know Thai settlement more profoundly Palin of Omise Thai office helped me!

The contents heard from her are as follows.

· Because there are few shops supporting credit cards in Thai, cash is often used in face-to-face settlement, and Palin also uses cards at least once every two weeks.

· Prices are cheaper than Japan, lunch is about 200 yen and you can have a satisfying meal. Jealous (we often need about 800–1000 yen in Tokyo).

· In some stores, customers have to pay the credit card fee to pay with their cards.

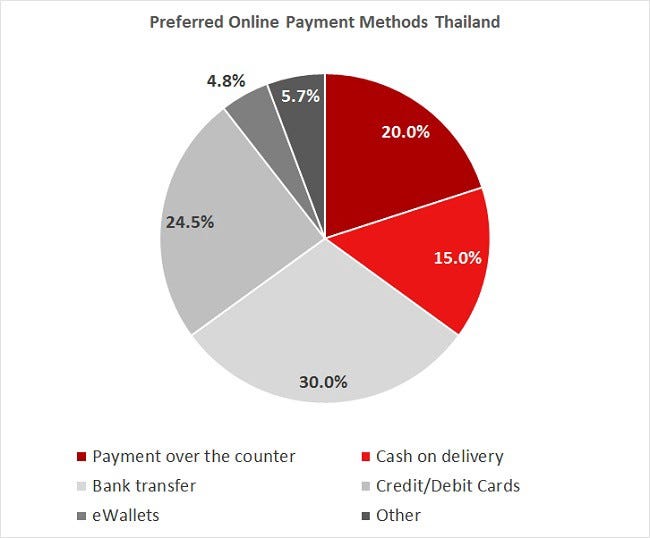

· In the case of online payment, bank transfer is often used (also she sent materials on online payment circumstances).

Cash payment, such as Cash on delivery and Payment over the counter, and bank transfer are mainly used. I feel that there is plenty of room for future settlement service development.

Summary

Though Thailand is a country with relatively high economic standards and settlement infrastructure in Southeast Asia, the means of settlement was limited mainly to cash and bank transfers, and it seemed to be still inconvenient now. Next time I would like to investigate Singapore, which has a higher economic level, and Indonesia, where venture companies such as Grab and Go-Jek in recent years are trying to penetrate the mobile payment market.

Reference material

(*1)GDP per capita (current US$):https://data.worldbank.org/indicator/NY.GDP.PCAP.CD

(*2)How to scale up financial inclusion in ASEAN countries:https://blogs.worldbank.org/eastasiapacific/how-to-scale-up-financial-inclusion-in-asean-countries

(*3)Thailand eCommerce Insights | 13.9 Million Online Shoppers in Thailand by 2021:http://www.eshopworld.com/blog-articles/thailand-ecommerce-insights/

詳細はこちらから

購読してくれてありがとう

メールにサインアップしていただきありがとうございます